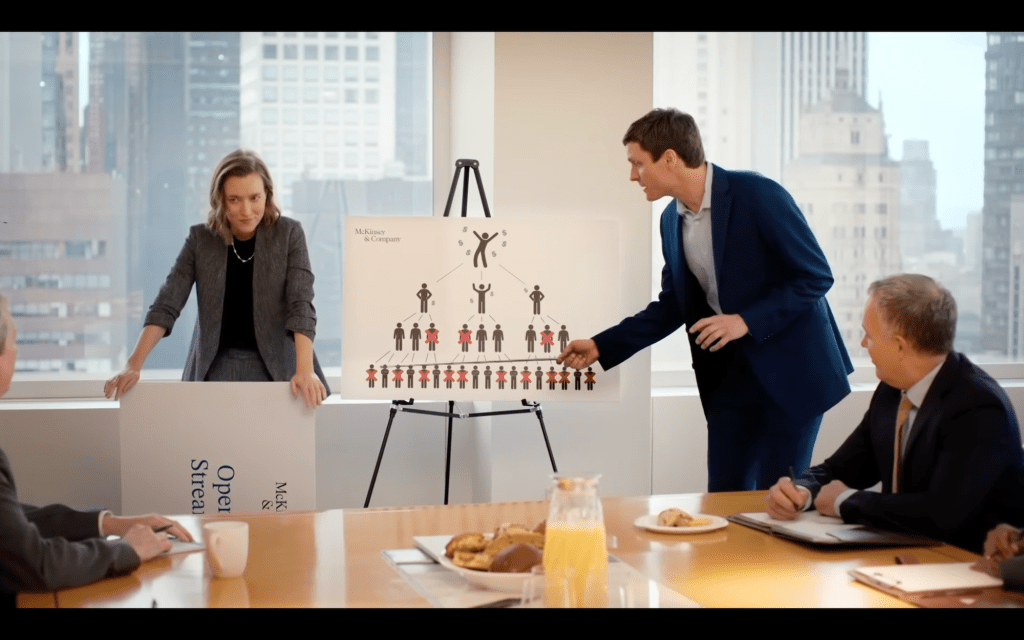

John Oliver’s Last Week Tonight with its well-researched and in-depth segments of journalism in satire’s clothing regularly manages to escape the 24-hour news cycle and instead set the agenda themselves. And if John Oliver takes on large consulting firms in general and McKinsey in particular, it is a must-watch for any student and scholar of management and organization studies. Check it out:

I would have enjoyed this piece very much, hadn’t it been all too accurate a depiction of systemic deficiencies in our contemporary corporate world. And while I really applaud the way the segment demonstrates that the problem with McKinsey is not one of “bad apples” but rather systemic, indeed, it does not really offer suggestions on how to improve the situation.

So what could be done to at least contain some of the systemic problems associated with large management consultant firms in both private and public sector contexts:

- Size and market concentration matter. Among the key reasons why conflict of interests become ubiquitous is the market dominance of the Big Three consultant firms (similar to the problematic dominance of the Big Four accounting firms). Aside from breaking up those firms entirely (which seems difficult under current antitrust regimes), a first step could be waiting periods after consulting projects are finished before these firms can be re-hired, as well as self-commitments to only contract with non-Big-Three firms after any contract with one of those. (In the case of accounting firms, switching the auditor every five years is already good corporate practice.)

- Special rules for particularly large consultancies: For consultancies above certain revenue thresholds, additional transparency regulations should apply, such as full and real-time client and project lists, including names of assigned consultants.

- Limits on public sector consulting: Introducing restrictive limits for consulting services across the public sector, together with legally mandated transparency for any consulting contract awarded there. Today, it is often easier to outsource whole operations to ridiculously expensive consultancies than to invest in building in-house capacities for fulfilling even basic public services. Of course, this would require acknowledging that public sector solutions can – and often will – be more efficient than purchasing ready-made market-based solutions.

- Tax and cap excessive earnings: Measures affecting both Big Three consultants and their top management clients would be higher taxes on the top one percent of top earners and restrictions on bonuses, which reward short-term orientation of consulting projects.

In addition to these rather structural measures, segments such as the one embedded above are important reminders of the limitations of the knowledge even the most reputable consulting firms are able to command – and of the conflicts of interest inherent to the fact that expensive management consultants are only hired by members of top management teams. So it should not come as a suprise that they first and foremost serve those people that have the power to hire them, with employees, shareholders and the public at large paying the price.